Maximise every appraisal: strategies top agents use to win instructions

By iamproperty In today’s market, sellers are more informed and selective than ever before. That means the market appraisal can no longer be seen as

By iamproperty In today’s market, sellers are more informed and selective than ever before. That means the market appraisal can no longer be seen as

In property, opportunities rarely wait for the perfect time. Deals progress quickly, buyers change their minds in moments, and the chance to impress a client

In the fast-paced world of property, trust is everything. Whether you’re an estate agent, conveyancer, mortgage broker or supplier, your reputation is what wins you

When you hear “ESTAS,” what’s the first thing that comes to mind? For many, it’s the exciting awards ceremony – the cheering, the champagne, and

Don’t Miss Out on the Property Event of the Year! Secure Your ESTAS Awards Tickets Now! The ESTAS Awards, the most eagerly awaited event in

In today’s competitive property market, it’s more important than ever to stand out. It’s not just about selling homes or processing mortgages; it’s about building

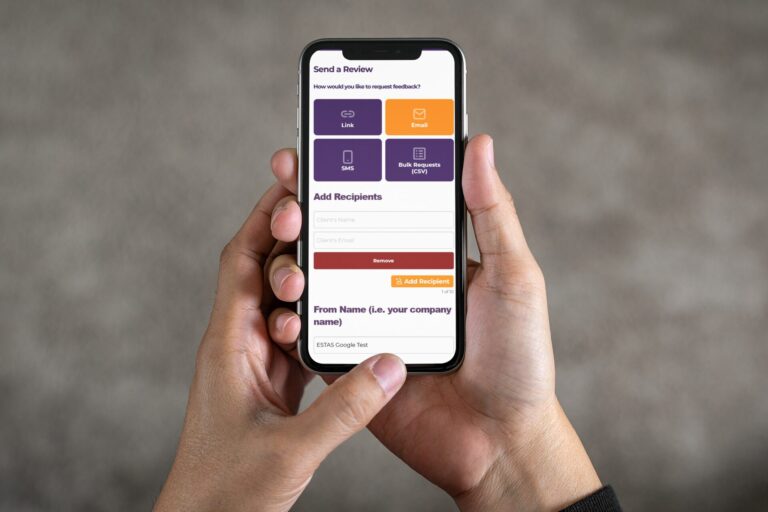

Let’s face it: in the whirlwind of running your property business, chasing customer reviews can feel like just another task on an already overflowing to-do

In today’s digital world, online reviews are essential for any business, especially those in the property sector. Potential customers rely heavily on reviews to make

In just a few weeks Christmas will be over, the decorations will be down, and a brand-new year will be stretched out before us, full

get in touch today and discover how ESTAS can power your business growth.

see the winners of the 2024 estas awards