Resources

When People Trust You, They Choose You

In this blog: In property, trust isn’t a buzzword. It’s the reason a homeowner picks one agent over another, why a buyer chooses a broker, or why a firm ...

Read More

Want To Stand Out This Year? Let Trust Lead the Way

In this blog: A new year always brings a fresh sense of opportunity. For estate agents, conveyancers, mortgage brokers, and suppliers across the property sector, ...

Read More

Finish strong: Turn today’s feedback into next year’s reputation

The final few weeks of the year can feel like a wind-down. But in property, this is your moment to power up. Every instruction, every ...

Read More

Build a Winning Reputation, One Review at a Time

In the property world, reputation is everything. It helps you win instructions, secure referrals, and build long-term trust in your community. But in today’s crowded, ...

Read More

Earn Your Place at the 2026 ESTAS Awards

When a client gives you their trust, it’s not just about handling a transaction, it’s about handling a moment that really matters. Whether they’re buying, ...

Read More

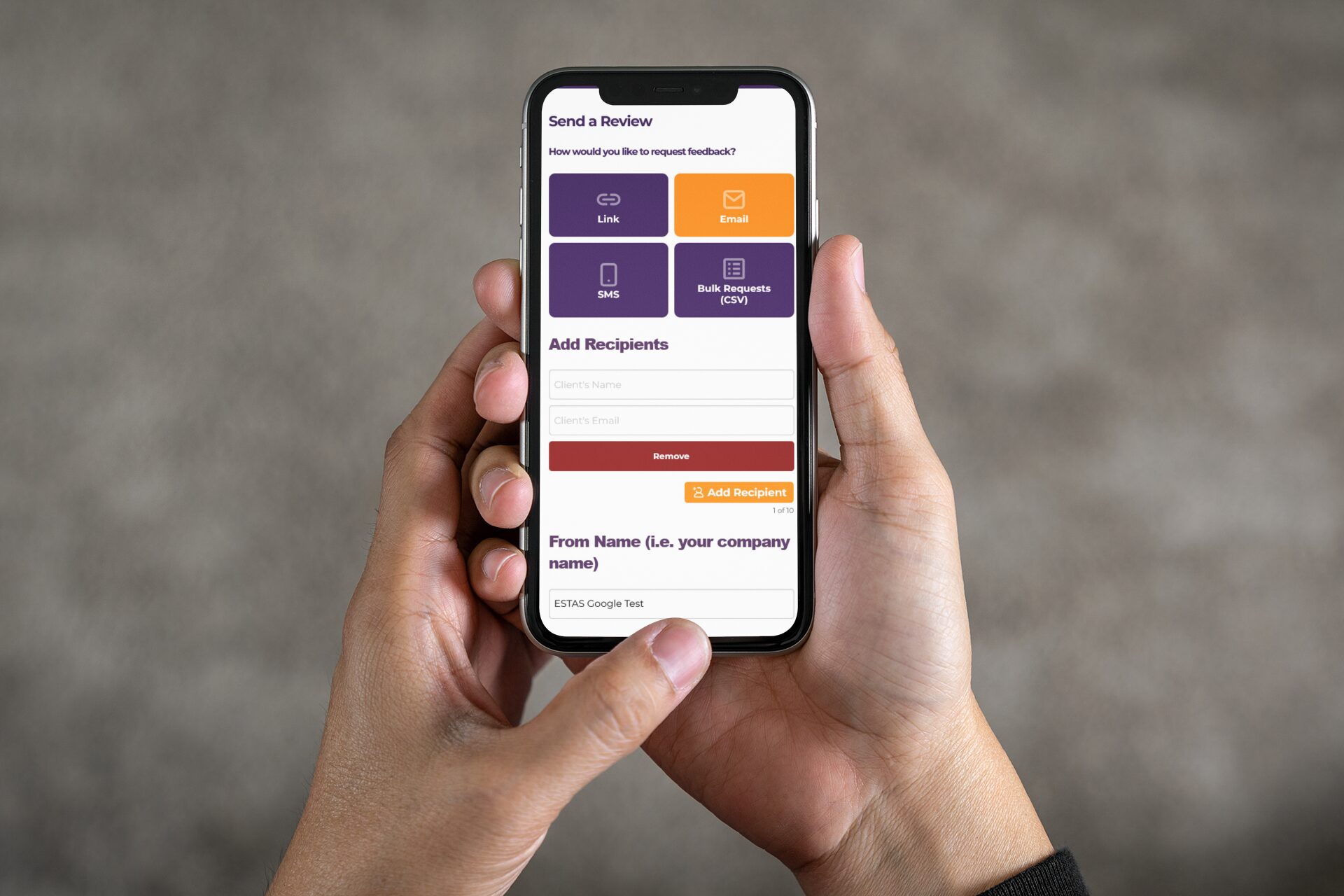

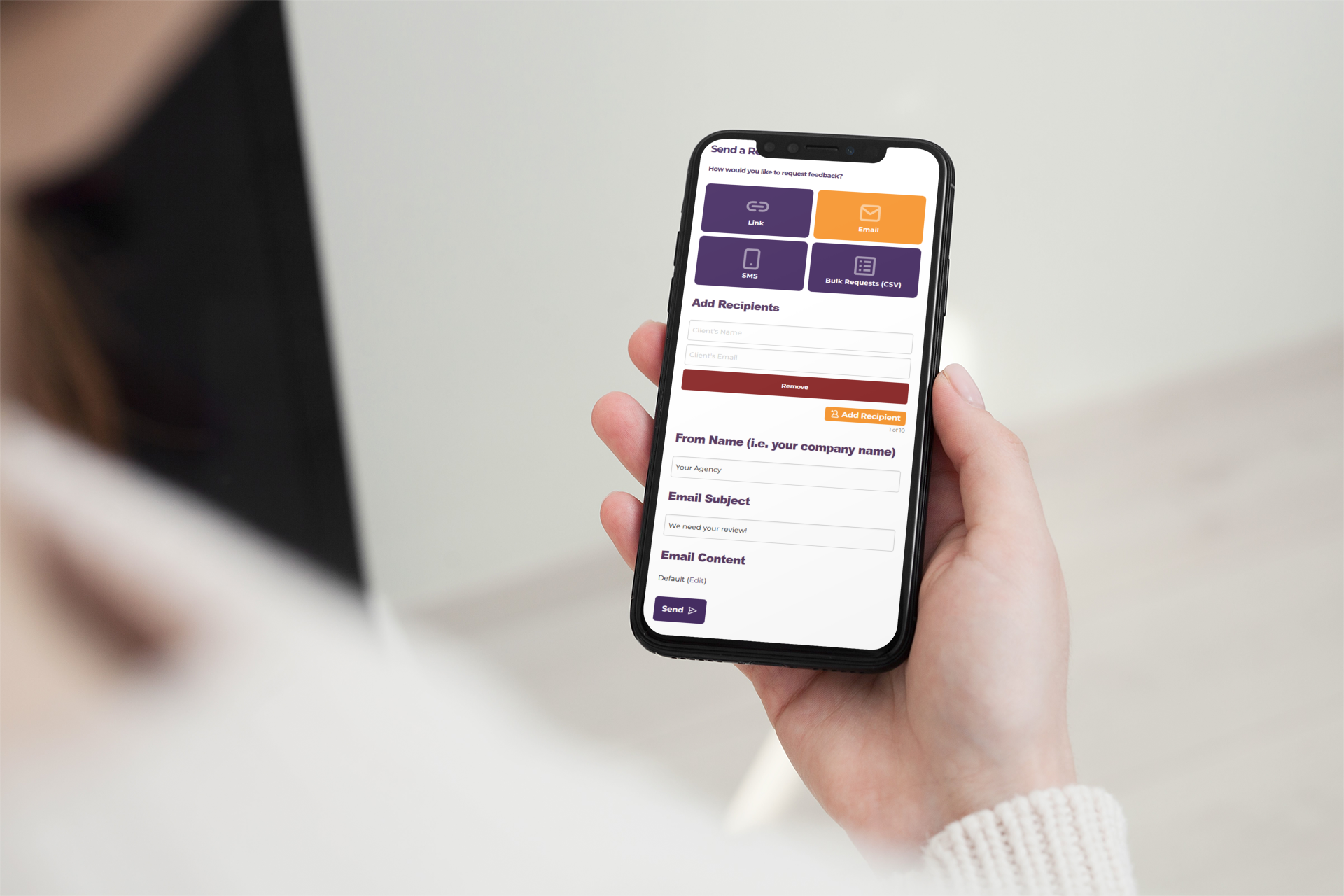

Manage Reviews and Feedback on the Go

In property, opportunities rarely wait for the perfect time. Deals progress quickly, buyers change their minds in moments, and the chance to impress a client ...

Read More

Why Reviews Matter More than Ever in Property

In the fast-paced world of property, trust is everything. Whether you’re an estate agent, conveyancer, mortgage broker or supplier, your reputation is what wins you ...

Read More

Beyond the Trophy: Achieve Summer Success with The ESTAS Advantage

When you hear “ESTAS,” what’s the first thing that comes to mind? For many, it’s the exciting awards ceremony – the cheering, the champagne, and ...

Read More

Last Call for Early Bird Savings

Don’t Miss Out on the Property Event of the Year! Secure Your ESTAS Awards Tickets Now! The ESTAS Awards, the most eagerly awaited event in ...

Read More

Unlock Awards Success with 5* ESTAS Reviews

In today’s competitive property market, it’s more important than ever to stand out. It’s not just about selling homes or processing mortgages; it’s about building ...

Read More

Your Easy Path to Great Reviews

Let’s face it: in the whirlwind of running your property business, chasing customer reviews can feel like just another task on an already overflowing to-do ...

Read More

Why Are My Google Reviews Disappearing?

In today’s digital world, online reviews are essential for any business, especially those in the property sector. Potential customers rely heavily on reviews to make ...

Read More

Ignite Your Team in 2025 with ESTAS!

In just a few weeks Christmas will be over, the decorations will be down, and a brand-new year will be stretched out before us, full ...

Read More

ESTAS Awards 2024: More Than Just a Trophy – A Catalyst for Recognition and Business Growth. Winners Share Their Stories.

The 2024 ESTAS Awards have come to a close, but the celebrations continue. The awards are unique in that winners are determined solely by verified ...

Read More

5 Ways ESTAS Can Help You Improve Your Customer Service

If you’re on the fence about becoming an ESTAS member, here’s why it’s a great idea! You’re already successful in the property world. You know ...

Read More

Don’t Risk ESTAS FOMO

The champagne has been popped, the confetti has settled and the winners of the 21st annual ESTAS Awards are proudly displaying their trophies. Are you ...

Read More

Celebrating 21 Years of The ESTAS

As we approach the 21st annual ESTAS Awards, we wanted to take a moment to reflect on more than two decades of recognising and celebrating ...

Read More

A Summer of Success Stories: Building Trust One Review at a Time

At ESTAS, we know that real stories have the power to deliver real results. That’s why this summer, we’re encouraging businesses across the property industry ...

Read More

Grow Your Business Through 5* Reviews!

Winning an award is just one of the many benefits of being an ESTAS member. In today’s competitive market, trust and credibility are everything. At ...

Read More

Ready, Set, Review: Let Happy Customers Drive Your Business Growth in 2024

Google estimates that 70% of a customer’s buying decision is made online before they contact you for the first time And who are customers going ...

Read More

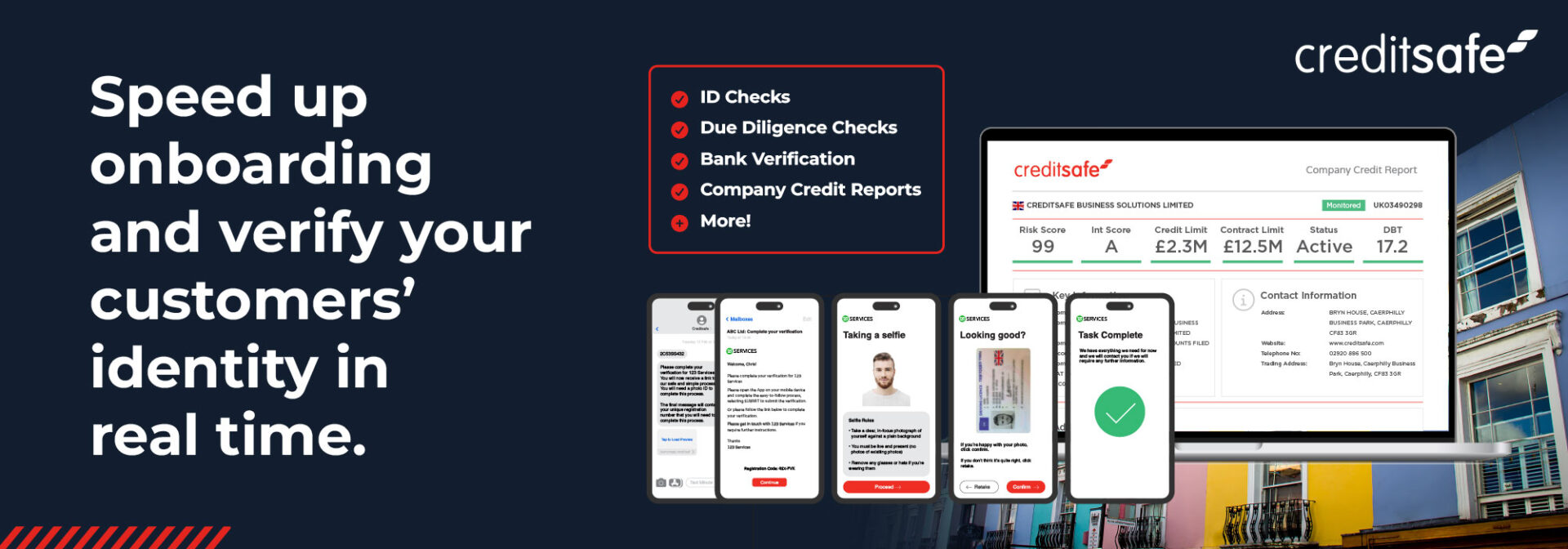

How Creditsafe helps letting & estate agents make faster, safer decisions

In a market where speed and trust make all the difference, letting and estate agents need reliable information at their fingertips. Whether you’re qualifying a ...

Read More

AN INDUSTRY ALIGNED: WHY 2026 MARKS A TURNING POINT FOR AGENTS AND CONVEYANCERS

The UK property market enters 2026 with something it has rarely enjoyed: alignment. For years, estate agents, conveyancers, lenders and consumers have voiced frustrations that ...

Read More

When Compliance Falls Short: Why Source of Funds and Wealth Still Catch Out Estate Agents

For many estate agents, compliance is something they genuinely care about and invest time in. Checks are completed, documents are collected, and third-party tools are ...

Read More

Growth doesn’t wait, and neither should you

As the calendar flips to a new year, the excitement of fresh opportunities is palpable! But too many estate agencies start the year already playing ...

Read More

Transparency in property: The journey from ambition to expectation

By Matt Gilpin, Founder and CEO of Sprift For years, property professionals have shouldered the frustration of watching deals slow down or fall apart because ...

Read More

Residential market research report: Key trends you need to know

Conveyancing remains one of the most critical stages in the property transaction process, yet delays continue to frustrate both professionals and clients. Landmark’s latest market ...

Read More

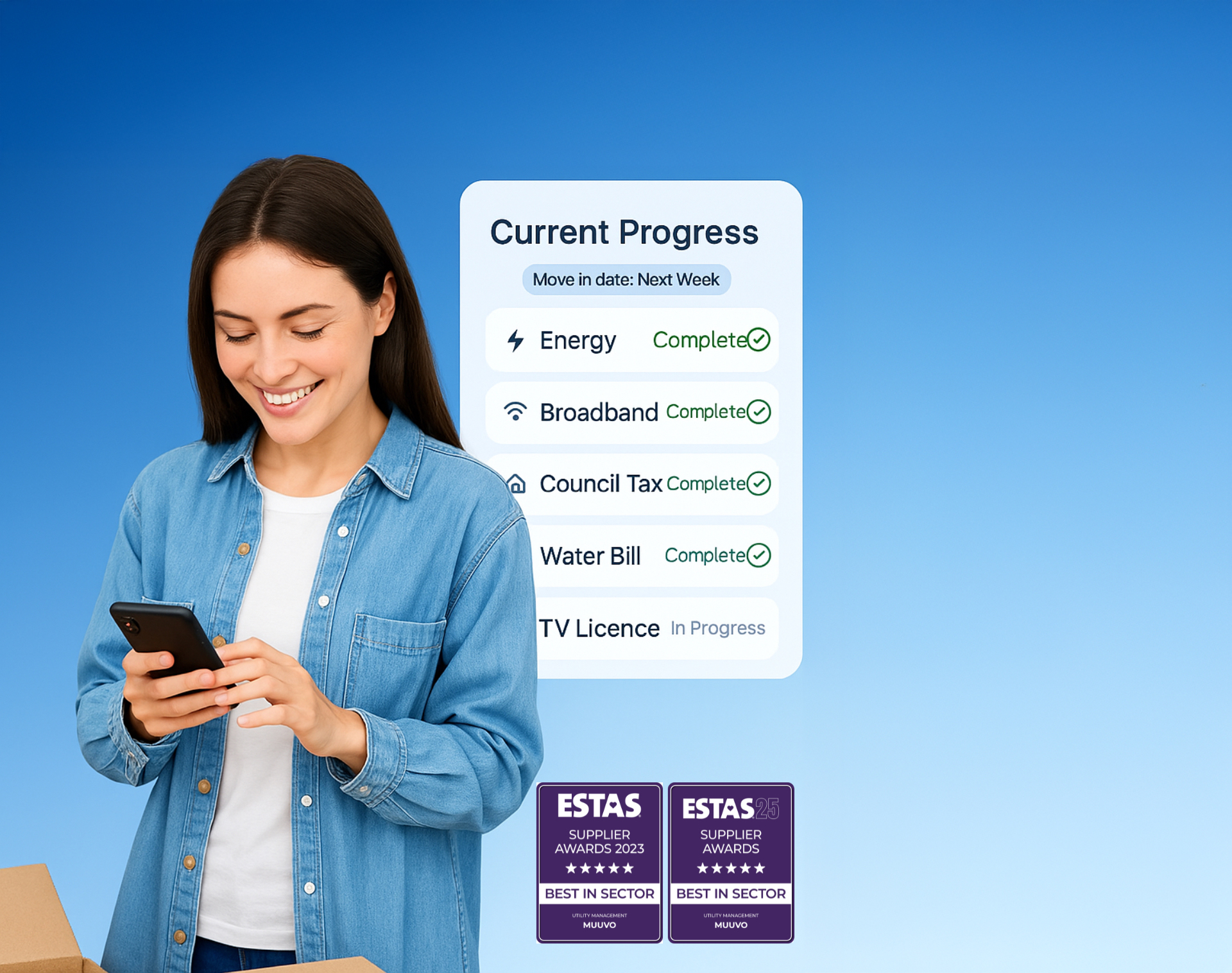

Tenant Shop Agents Begin Migration to Muuvo’s Multi-Award-Winning Platform

A significant transformation is underway in the UK’s change-of-tenancy technology sector as Tenant Shop’s national network of letting agents transitions to the Muuvo platform. This ...

Read More

Recognised at The ESTAS, trusted by agents every day

Congratulations to all winners and finalists at this year’s ESTAS awards! It was an inspiring showcase of the people and businesses who are raising the ...

Read More

Thriving in a Challenging Market: 7 Ways Estate Agents Can Build Confidence and Resilience in 2026

By iamproperty Confidence across the UK property market remains mixed as we approach 2026. Economic shifts and policy speculation continue to influence buyer and seller ...

Read More

Trusted by the best in the business. You.

At Reapit and PayProp, we understand the pressure you face every single day. Winning instructions, chasing completions, keeping landlords happy, ensuring rent is paid on ...

Read More

Giving estate agents more agency

By Coadjute Coadjute is the UK’s leading technology platform for estate agents, backed by Rightmove, Lloyds Banking Group, Nationwide and NatWest. We exist to support ...

Read More

Maximise every appraisal: strategies top agents use to win instructions

By iamproperty In today’s market, sellers are more informed and selective than ever before. That means the market appraisal can no longer be seen as ...

Read More

| DATE | KEY DATES AND EVENTS |

|---|---|

| 1 December 2025 | Ticket sales open for following year’s awards |

| 31 December 2025 | Sign up deadline to be eligible for following year’s awards |

| 1 March 2026 | Awards review window closes for The ESTAS Awards 2026 |

| 1 March 2026 | Review window opens for The ESTAS Awards 2027 |

| 16 October 2026 | ESTAS Awards (Grosvenor House, London) |

get in touch today and discover how ESTAS can power your business growth.