In a market where speed and trust make all the difference, letting and estate agents need reliable information at their fingertips. Whether you’re qualifying a prospective tenant, onboarding a new landlord, or assessing a business client, one thing remains true – good decisions depend on good data.

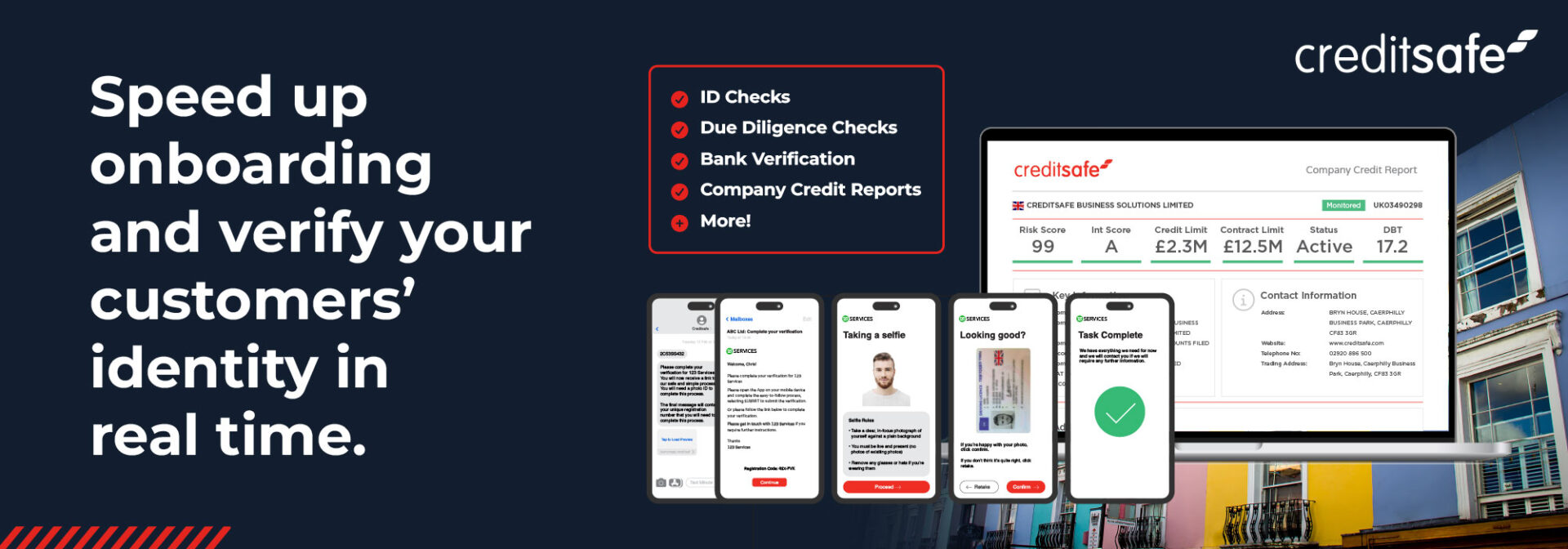

That’s where Creditsafe comes in.

Who we are:

Creditsafe is one of the world’s most-used business intelligence providers, trusted by more than 100,000 companies globally. Our core mission is simple: make company and consumer information easy to access, easy to understand, and easy to act on.

Across the UK and Ireland, we support businesses of all sizes with tools that reduce risk, improve compliance, and speed up everyday decision-making.

How we support letting & estate agents:

The property sector relies heavily on accurate, up-to-date information. Creditsafe provides a suite of tools designed to help agents protect their businesses, reduce time spent on admin, and deliver a smoother experience for customers.

Here are the key areas where we add real value:

1. Tenant & Guarantor Screening

Make confident decisions with:

- Verified identity checks

- Affordability insights

- Income and employment verification

- Credit history and risk indicators

These tools help agents reduce arrears, spot fraudulent applications, and streamline the referencing process.

2. Landlord & Supplier Due Diligence

It’s not just tenants you need to trust.

Creditsafe gives you clear visibility into:

- Landlord identity and financial standing

- Contractor or supplier creditworthiness

- Business stability and CCJ history

- This ensures you’re partnering with reliable third parties and protecting your reputation.

3. Anti-Money Laundering (AML) & Compliance

With increasing regulatory pressure from HMRC supervision to the latest AML guidance agents need straightforward tools to stay compliant.

Creditsafe offers:

- Digital ID verification

- PEPs & Sanctions screening

- Ongoing monitoring for higher-risk clients

No more manual checks or outdated spreadsheets. Just simple, compliant processes.

4. Faster Onboarding & Better Customer Experience

Consumers expect everything to be quick and seamless.

Creditsafe’s data and automation tools allow agents to:

- Reduce admin time

- Get instant verification results

- Move tenants and buyers through the pipeline faster

- Less friction. More trust. Happier clients.

We know the challenges agents face – regulation, fraud, rising admin, tighter margins, and our job is to help you navigate them with confidence.

With dedicated account managers, UK-based support, and custom solutions for property businesses, we’re here to simplify your workflow and strengthen your decisions.

If you want to learn more about how Creditsafe can save you time and money, get in contact with Creditsafe’s Property Market Specialist, Richard Thomas [email protected]